Never Vanguard

Photo by Laran Kaplan

What is the Never Vanguard Pledge?

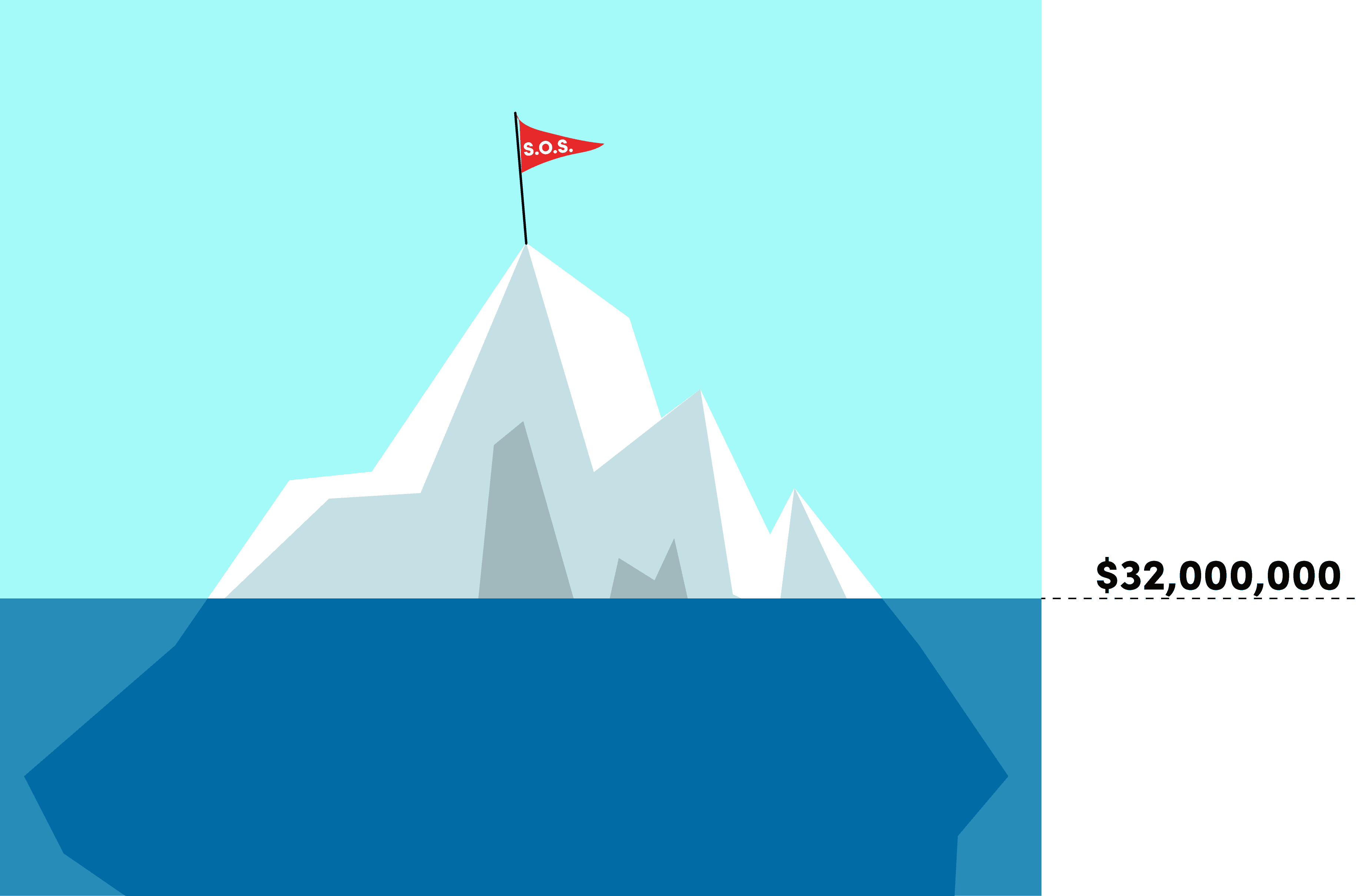

Vanguard is the world’s #1 investor in fossil fuels, which are destroying our climate and communities. To get this huge asset manager to change, we’ve written letters, made phone calls, delivered petitions, and asked company leadership to meet with us to hear our concerns. We’ve even gotten arrested at Vanguard headquarters and prayed outside the CEO’s house.

We can’t continue to put our trust or our savings in a company that is on this reckless course. It’s time to pledge Never Vanguard, together.

The Never Vanguard pledge is for anyone willing to take a stand against corporate greed. For some, signing the pledge will be a commitment to move savings invested with the asset manager or in its funds. For others, pledging will mean promising not to work for Vanguard, or publicizing the negative effects of its investments on social media or in an op-ed. As you answer the questions below, you will be directed to different options based on your situation. If you have already moved money out of Vanguard or its funds due to environmental or climate concerns, please let us know how much you moved so we can count you as part of our collective total.

While moving money or refusing to work for Vanguard can be individual acts of integrity, such actions become much more powerful when we take them publicly and collectively. Please join us by pledging Never Vanguard below! You can also read answers to frequently asked questions at the bottom of this page.

Photo by Rachael Warriner