Vanguard S.O.S.

Photo by Rachael Warriner

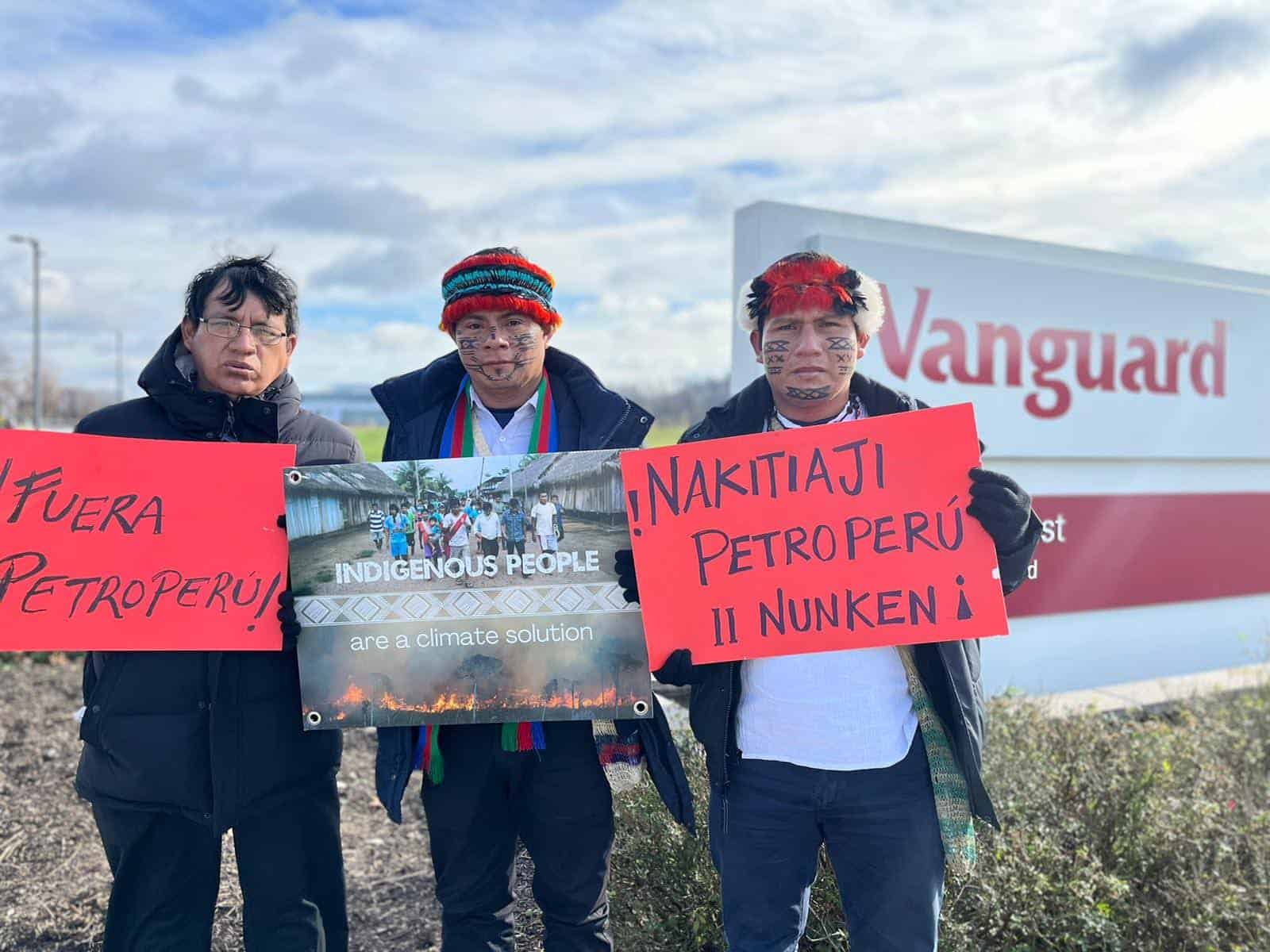

Photo by Amazon Watch

Based in Philadelphia suburb Malvern, PA, Vanguard is the second largest investor in the world, managing over $7 trillion on behalf of millions of clients. You may not have heard of it, but Vanguard is driving the climate crisis. Its investments prop up the industries destroying our climate and harming our communities.

How does Vanguard drive climate chaos?

- With about $270 billion invested in fossil fuel companies, Vanguard is world’s biggest investors in fossil fuels.

- Vanguard invests about $180 billion in projects expanding fossil fuel infrastructure at a time when experts agree that we need to halt fossil fuel expansion to prevent the worst effects of climate catastrophe.

- Vanguard has one of the worst voting records on climate-related shareholder resolutions, ranking 65 out of 68 asset managers for its shareholder voting.

Vanguard has built its business on peoples’ retirement, but its investments are destroying the future now.

However, it’s not too late to change course.

If Vanguard executives decide to take bold action and Vanguard investors hold the asset manager accountable, we can ensure that we’re leaving a livable future for our communities and generations to come.

Around the world, activists are pushing Big Finance to take responsibility for its part in climate destruction by stopping the money pipeline. We have a long way to go, but the wins we’ve seen so far show that change in fossil fuel finance is possible despite what financial leaders have said for decades. Vanguard has no excuses left.

It’s time for Vanguard to deal with its climate problem. Vanguard must stop pouring money into the industries destroying our environment and driving human rights abuses and start using its massive power to push for climate action across the global economy.

Photo by Rachael Warriner

We’re Demanding that Vanguard:

- Use its power and influence as a shareholder to push the companies it invests in to do better on climate change

- Offer climate-responsible funds as mainstream products that are promoted by financial advisors

- Exit its investments in fossil fuel companies that refuse to transition their businesses to be in alignment with a livable future

Frequently Asked Questions

If you’re a Vanguard customer, we invite you to join us in pledging “Never Vanguard”!

The Never Vanguard pledge is for anyone willing to take a stand against corporate greed, including Vanguard customers who want to move savings invested with the asset manager or in its funds. (If you have already moved money out of Vanguard or its funds due to environmental concerns, please let us know how much you moved so we can include you in our collective total.)

While moving money can be an individual act of integrity, such actions become much more powerful when we take them publicly and collectively. So, please join us by pledging Never Vanguard!

Screening fossil fuel companies out of index funds may be more difficult than with actively managed investments, but it is possible – and the stakes of this moment call for bold action to ensure a livable future!

Index funds attempt to follow a cross section of the stock market, to give investors steady gains over time. But Vanguard still has discretion over which companies to invest in when it assembles a diverse fund. Vanguard can screen the worst fossil fuel companies out of its index funds without straying too far from the benchmark of the original indices. Additionally, Vanguard can create funds that are already divested from fossil fuels and make them an accessible option for new customers, thus substantially increasing the amount of money invested in climate-friendly funds.

References:

Passive investors’ hands aren’t tied on fossil fuels. Responsible Investor.

Vanguard Group: Passive About Climate Change. Institute for Energy Economics and Financial Analysis.

Vanguard and Universal Ownership. Universal Owner.

The Passives Problem and Paris Goals: How Index Investing Trends Threaten Climate Action. The Sunrise Project.

Vanguard is the world’s two largest investors in coal, oil, and gas. It has the most passive ownership (through index funds) of the world’s top 200 greenhouse gas emitters.

When Vanguard shows up at the annual shareholder meetings of other corporations, it votes for business as usual. Vanguard continues to oppose too many shareholder resolutions related to climate issues and support corporate directors who are stalling on climate action.

Vanguard still has no policy to divest its actively managed funds from coal companies and it has fewer ESG (investment funds using environmental, social, and governance criteria to screen out certain companies) options than its peers.

While other large asset managers also have a long way to go, their actions so far show that change in finance is possible, despite what financial leaders said for decades. Vanguard has no excuses left.

Vanguard needs to:

- Be an active shareholder, supporting climate shareholder resolutions and voting out directors that don’t take climate change seriously,

- Offer climate-responsible funds as mainstream products that are promoted by financial advisors, and

- Make a plan to exit its investments in coal, oil, and gas.

References:

Climate in the Boardroom: How Asset Manager Voting Shaped Corporate Climate Action in 2021. Majority Action.

Vanguard Group: Passive About Climate Change. Institute for Energy Economics and Financial Analysis.

Vanguard and Universal Ownership. Universal Owner.

Because so much money is invested through Vanguard’s funds, it has enormous voting power at the annual meetings of almost all publicly traded companies.

Once a year, every publicly traded company’s stockholders get to vote on resolutions about how the company is run. Asset managers like Vanguard vote on behalf of all of their customers who have money invested in a certain company.

Because climate change poses such a profound risk to the whole economy, Vanguard has a fiduciary responsibility to its customers to hold the corporations driving climate change accountable to substantially reducing their emissions.

Vanguard needs to vote on shareholder resolutions that set companies’ emissions in line with no more than 1.5°C increase in global temperatures – the threshold for irreversible change – and vote against boards of directors that fail to align their companies with that goal.

If we push Vanguard in this direction, it could change Exxon, Chevron, and many of the biggest contributors to climate change!

References:

Proxy Voting 101. Morningstar.

Climate in the Boardroom: How Asset Manager Voting Shaped Corporate Climate Action in 2021. Majority Action.

We need Vanguard to significantly increase its investments in climate-friendly funds by making those funds more accessible to its customers.

Vanguard has a few ESG funds (investment funds using environmental, social, and governance criteria to screen out certain companies). But less than 0.5% of Vanguard’s assets under management were invested in ESG funds! That means Vanguard is still investing trillions of dollars of its customers’ money in standard funds. Having higher fees foe these few ESG funds has led to only marginal amounts of money being invested in more socially responsible funds, and a continuation of the status quo.

We believe in the power of customers taking strategic action to push for funds that reflect their values. That’s why the Vanguard S.O.S. campaign is organizing Vanguard customers to leverage their power and pressure Vanguard to deal with its climate problem. If you’re a Vanguard customer and want to get involved, contact Vanguard and let them know you want them to do better!

References:

Vanguard Group: Passive About Climate Change. Institute for Energy Economics and Financial Analysis.

Vanguard fund scores on fossil fuel investments. Fossil Free Funds by As You Sow.

Vanguard says it helps customers save for the future, but unless the company deals with its climate problem now, its customers will be paying the price for its climate inaction.

Vanguard invests about $270 billion in fossil fuels, and it’s already costing the company and its customers money. The Institute for Energy Economics and Financial Analysis found that Vanguard’s largest fund has underperformed almost 6% as compared to a benchmark that excluded fossil fuels. And this trend is only predicted to increase.

Plus, climate change threatens to profoundly hurt the economy across all sectors. So, if Vanguard and the other largest investors, insurers, and banks don’t take more responsibility for stopping the money pipeline to fossil fuel companies, Vanguard customers’ savings will take a significant hit across their diversified investments.

References:

Vanguard Group: Passive About Climate Change. Institute for Energy Economics and Financial Analysis.

Climate in the Boardroom: How Asset Manager Voting Shaped Corporate Climate Action in 2021. Majority Action.

Swiftly getting its investments in line with cutting global emissions in half by 2030 and reaching credible net zero emissions by 2050 is just the beginning of what Vanguard needs to be doing to deal with its climate problem.

Net zero means reducing greenhouse gas emissions enough that any leftover emissions can be removed from the atmosphere by planting trees or using carbon capture and storage technologies.

It was a positive development when Vanguard joined the Net Zero Asset Manager initiative in 2021 and disappointing when it quit the initiative the following year.

Vanguard should be taking ambitious, meaningful climate action that recognizes the need for an immediate end of fossil fuel expansion and real reductions in the burning of fossil fuels now. We cannot gamble with any net zero plans that dangerously allow for heating the planet up past 1.5 ℃ and rely on unproven methods for removing carbon from the atmosphere to correct our overshoot.

Sources:

https://www.netzeroassetmanagers.org/#

https://www.universalowner.org/missingthetarget

https://blackrocksbigproblem.com/blackrocks-2030-interim-climate-targets/

We’d love for you to join us in our campaign to push Vanguard to invest for a livable future. Whether you have savings in Vanguard or can’t even imagine having savings, when we come together and take strategic action, we can have a major impact and change business as usual. And making Vanguard deal with its climate problem could be one of the most powerful actions you take to fight climate change!

- Check out our upcoming events and actions and find one you’d like to join.

- If you’re ready to volunteer to help make our next action, phonathon, meeting, or prop-making party a success, sign up here to let us know.

- If you’re able, please support our work by making a donation.

- And if you invest money with Vanguard, learn more about how you can leverage your power as a customer.